This is an excerpt from The Future of Fintech in the Middle East 2023 report.

Data plays an important role for the growth of fintech in any region. It can help financial services participants understand their customers’ needs and is used to protect users from bad actors. Access to better data can also improve customer interactions

because of increased analysis capabilities. As regions like the Middle East begin to develop their payments capabilities, the ways in which data is leveraged need to be protected. Increased amounts of customer data require increased levels of data privacy

and greater protection of customer data from security risks.

The Middle East is a region with rich fintech potential. Many countries in the region are pursuing more open data initiatives like open banking. As these progress and develop, they will offer plenty of opportunities to the fintech market, but there will

also need to be vigilance over data security and privacy.

Data can support the Middle East’s underserved and unbanked

The region has seen some recent developments in payments patterns brought on by the Covid-19 pandemic. An example of this is the UAE, where a YouGov poll found that 63% of residents viewed it as positive for the country to be cashless.

Jayesh Patel, CEO, Wio Bank comments on this move towards the digital: “Since the onset of the Covid-19 pandemic, there has been a significant global shift from cash to digital money. This shift has opened up opportunities for fintechs to serve markets that

were previously underserved. Some of these FinTechs are smaller start-ups while others are larger, more established players like e-money that can provide better financial inclusion.”

Many areas in the Middle East are still reliant on cash, which raises concern for financial inclusion. However, Abdulla Almoayed, founder and CEO of Tarabut Gateway, argues that “the region’s regulators are implementing various digital initiatives to improve

financial inclusion, given the heavily cash-focused society. One approach is introducing digital payments across the public and private sectors; allowing better payment tracking and an improved understanding of the banked and unbanked populations.”

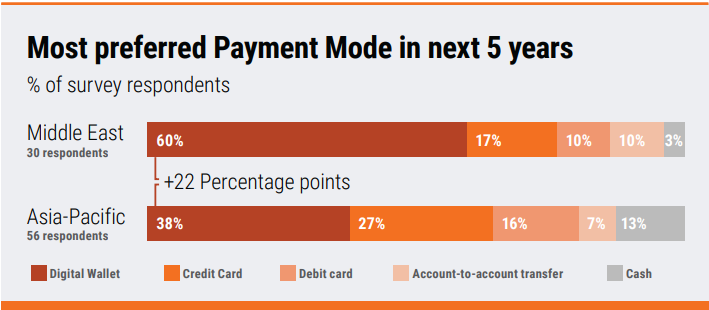

Additionally, digital wallets are proving to be an area of growth, as shown in the diagram from research conducted by McKinsey. This progress in digitalisation is something noted by Nameer Khan, chairman at MENA Fintech Association and founder at FIL: “To

improve financial inclusion in the cash-focused Middle East, governments and financial institutions are promoting digital financial services, mobile banking, and digital wallets. Saudi Arabia's Financial Sector Development Program aimed to increase non-cash

transactions to 70% by 2030 (Saudi Vision 2030). Moreover, organisations like the Central Bank of the UAE are focusing on financial literacy programs and leveraging new technologies like blockchain to extend financial services to underserved populations.”

Jorge Camarate, partner at Strategy& and the leader of the financial services practice in the Middle East and Dr. Antoine Khadige, Strategy& Middle East, part of the PwC network jointly comment on this: “Regulators and governments in the region are pursuing

several initiatives to promote financial inclusion. Some of the initiatives focus on increasing accessibility and reducing the cost of conventional banking accounts. Others look to promote alternative ‘store of value’ and payments solutions such as electronic

wallets operated by telcos, retailers and fintechs, among others. Finally, some governments have looked to accelerate the transition to cashless by mandating the adoption of electronic payments solutions by all qualifying merchants.”

The Middle East will need to ramp up data sharing

As it stands, the Middle East is in the early stages of data sharing. For example, the Global Data Barometer gave the UAE, Jordan, and Oman overall data scores of 26.7, 34.5, and 14.1 respectively. This is compared to a country like the UK which received

a score of 64.5, or Estonia which received a 67.4.

The lower rates of data penetration and openness is noted by Almoayed. “We can take open banking, and data sharing, as clear examples of data’s importance. Access to financial data in the MENA region is still in its early stages. This has prompted the introduction

of open banking, which stresses the importance of opening up financial data. Traditionally, banks have been custodians of such data, but via open banking, customers now own their data. They provide consent on whom they choose to share their data with, and

what data they want to share.”

Khan shares this position: “Fintech companies can bridge their data gap by collaborating with various stakeholders, including governments, financial institutions, and technology partners. According to a MAGNiTT report, the MENA region witnessed a 48% annual

growth in AI funding in 2022. By sharing data securely and ethically, fintech companies can leverage advanced analytics and AI technologies to gain insights and deliver better financial services. Initiatives like open banking can help accelerate this process

and ensure a level playing field for all market participants.”

Open banking can be seen as an area with great potential within the Middle East, but more must be done in regard to the sharing of data so these initiatives can flourish. Almoayed continues: “Building an open banking infrastructure platform which enables

a regulated sharing of data, can help bridge the data gap. This platform would connect a network of banking institutions across the region, for fintechs and other businesses to access financial data consensually. Secure sharing of such data allows banks and

fintechs to learn more about the customer and their needs, helping them build more personalised products and services.”

Indeed, currently many countries within the Middle East have begun their steps towards open banking. Bahrain launched its Open Banking Framework in October 2023. In March 2023, Qatar’s Central Bank issued a Fintech Sector Strategy Summary, of which open

banking architecture was a key highlight. Jordan also released its Open Finance Framework in November 2022, and the UAE launched its Financial Infrastructure Transformation Programme (FIT Programme) to be fully implemented by 2026.

However, Almoayed warns that open banking generally does not go far enough: “open banking is limited to current accounts, savings accounts, and credit cards. Open finance is the next step in the open banking evolution - expanding to a full suite of financial

products; mortgages, insurance, investments, and pensions. The ultimate goal is achieving open data, which makes even more data sources accessible."

The future of fintech in the Middle East is through open finance and open data

Opening up data does come with a range of risks which legislators and customer need to be aware of and prepared for. One of these is the general protection of customer data. Patel argues: “it's important to recognise that the data belongs to the consumer,

and they must have control over what data is shared. As new regulations, such as open banking, become available, consumers will have more options for allowing access to their data.

“Fintechs must prioritise the protection of consumer data and respect the data sharing permissions provided by the consumer. While this process continues to evolve, it's crucial for fintechs to focus on data governance and privacy. Additionally, fintechs

can leverage advanced analytics and AI to extract insights from data and create better solutions and products for their customers, further bridging the data gap.”

However, there is also the ever-prominent risk of data breaches as noted by a number of commentators noted. Khan pointed to a study conducting the University of Cambridge which “found that the global cost of data breaches could reach $6 trillion annually

by 2023. Financial institutions need to invest in robust cybersecurity measures and access control mechanisms to protect sensitive data and maintain trust with their customers.”

Patel comments: “While big data presents many benefits, it also poses security risks to financial institutions. Financial institutions in the Middle East, like those around the world, have access to a vast amount of confidential and private information.

It is critical that they prioritise the security and protection of this information. Fortunately, financial institutions have a strong track record of doing so. Even with the introduction of open banking, investments in security layers, data security, and

sharing rights, help ensure that data privacy and governance continue to be upheld as they always have been by financial institutions.”

Dhriti Nath, product manager, NOW Money also adds: “Big data presents both opportunities and challenges for financial institutions in the Middle East. While big data analytics can help financial institutions in the region gain valuable insights into customer

behaviour, identify potential fraud and make more informed business decisions, it also poses significant security risks.”

Another risk which should be considered within the move to more open data is how financial data can be used by authoritarian governments on their populations. Many of the Middle Eastern countries have lower rankings on the Global Democracy Index, making

this more relevant here. Improved data penetration offers the Middle East plenty of opportunity for growth within its financial services and fintech sector. The groundwork for this growth is already being put in place through open banking and open finance

legislation. However, there are areas of risk which need to be considered moving forward.