This is an excerpt from The Future of Fintech in the Middle East 2023 report.

There is an interesting two-pronged dynamic at play which is arguably giving the Middle East’s blockchain market a unique edge. On one hand, in certain countries across the region, cryptocurrency has seen strong appeal from users looking to access antigovernment

money. With a large number of authoritarian regimes, sanctioned countries and untamed inflation, it’s clear to see why crypto would gain a strong foothold in the region. On the flip side, certain governments are actively creating innovative regulatory frameworks

that aim to reinvigorate and modernise financial markets – attempting to evolve the market into a legitimate hub for crypto firms to thrive.

Abu Dhabi, UAE and Bahrain, for instance, have been welcoming of blockchain technology, going above and beyond to work with crypto companies and to build regulatory frameworks that are assisting to usher in the technology. Saudi Arabia, though initially

opposed to the uptake of the technology, appears to be taking a more favourable stance.

John D’Agostino, a senior adviser to Coinbase, was quoted by Politico in 2022 explaining this pressure: “Where you see less trust in government you see more aggressive blockchain adoption, where you see more trust you see less[…]The exception is the UAE,

in that you have a very trusted, respected government that is being extremely progressive about installing blockchain solutions at the government level.”

Nameer Khan, chairman at MENA Fintech Association and founder of FIL, agrees that Middle Eastern governments have played a crucial role in driving blockchain adoption. “For instance, Saudi Arabia and the UAE led the way in the MENA region's AI and blockchain

revolution, with a joint $1.1 billion fund for AI and blockchain projects. Saudi Arabia's Vision 2030 highlighted how important blockchain was for economic diversification and technological advancement. When governments lead from the front it is a strong indicator

towards the economic potential ahead.”

Meaningful interest around blockchain adoption seems to have first taken hold in Gulf states during 2016. At the time, Bahrain was focused on assessing the legal implications of blockchain technology, and building the required supervisory frameworks it would

need within financial services. The UAE was focused on the current and future uses of blockchain across government, commercial and financial services.

Middle Eastern governments give blockchain the green light

By 2018, the UAE launched the Emirates Blockchain Strategy 2021, which aims to transfer 50% of government transactions to blockchain by 2021. In 2016, Dubai’s government established the Global Blockchain Council, aiming to research current and future blockchain

applications and transaction systems. The Council has already succeeded in establishing new firms that specialise in blockchain platform design for smart contracts development, digital asset exchanges and digital document transfers.

Jayesh Patel, CEO of Wio Bank, explains that “with the support of governments across the region who are openly experimenting with the technology and sharing the benefits it can provide over traditional technology processes, we’re likely to see more and more

sectors implement the technology soon.” Patel adds that governments in the MENA region are increasingly leveraging blockchain technology to improve and streamline public services, as well as in the private sector, whether it's in real estate or banking, to

optimise business processes.

The UAE has been a global leader in blockchain innovation since they established the Emirates Blockchain Strategy in 2018, and the UAE Central Bank recently announced plans to launch its own digital currency, central bank digital currency (CBDC). Saudi Arabia

has also been an early adopter as part of the Saudi Vision 2030 national programme, with plans to integrate blockchain technology in the country.

However, increasing crypto uptake hasn’t been seen by all as a positive evolution. The UN Trade and Development Body (UNCTAD) has called for action to curb cryptocurrencies in developing nations. The agency has warned that while the use of some digital currencies

has been beneficial for some individuals and institutions, they are an unstable asset which can bring social risks and costs. It went even further as to say that their benefits are overshadowed “by the threats they pose to financial stability, domestic resource

mobilisation, and the security of monetary systems.”

Rapid crypto growth attracts private and public investment

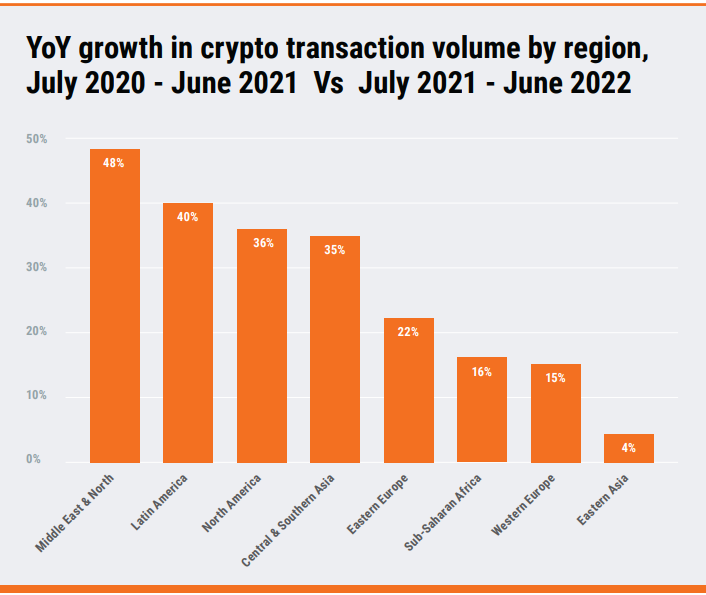

Jorge Camarate, partner at Strategy& and leader of the Financial Services practice in the Middle East, states that the Middle East may be one of the smaller crypto markets by size, however, recent data from Chainalysis suggests that the region exhibited

the fastest growth rates in 2022. The Chainalysis data Camarate is referring to can be seen in the graph below, which shows strong year-on-year growth in crypto transaction volume in the Middle East and North Africa.

Camarate elaborates that Middle Eastern regulators have extensively leveraged “lessons learned” to introduce regulations that strike the right balance between promoting innovation and protecting consumers. “In fact, the Emirate of Dubai has adopted its first

crypto law and formed the first independent virtual asset regulatory body.

“More recently, in April 2023, the Central Bank of the UAE launched its Central Bank Digital Currency implementation in partnership with R3 and G42. Earlier this year, Saudi Arabia’s Capital Market Authority announced that regulations for Security Token

Offerings (STO) will be out in 2023. Also, NEOM Tech & Digital, a subsidiary of the $500 billion signature Saudi megacity NEOM, has rebranded itself as Tonomus as it plans to invest more than $1 billion into the metaverse.”

According to Patel, what makes the Middle East such an attractive option for blockchain firms and investors is that governments across the MENA region have introduced initiatives and legislation to support growth, enable innovation, and protect investors

in the industry. A clear of this example is the Dubai Virtual Asset Regulation law, Patel explains, which was passed last year to protect investors in the space and act as a global benchmark for others to govern the virtual asset industry. “Continuous efforts

like this to build a stable regulatory environment are likely to boost investor confidence in the region and help to promote long-term growth in the crypto and blockchain sector.”

The Middle Eastern financial services industry and fintech is embracing blockchain

Financial institutions in the region embraced blockchain for various applications, explains Khan, with cross-border payments, trade finance, and identity verification a handful of examples.

“Some of the fintech startups made remittances more efficient using blockchain, cutting costs and streamlining processes. The booming crypto market in the region also spurred further blockchain adoption in the financial services industry.”

The Central Bank of UAE as a part of the recently announced Financial Infrastructure Transformation (FIT) programme, has said a digital currency was one of a list of nine projects, which also includes the country’s first card payment platform - an instant

payments system.

Khan explains: “Plus, cross-collaboration between Middle Eastern governments have been establishing initiatives to push towards a cashless society. For example, the central bank of the UAE is working with the Saudi Arabian Monetary Authority (SAMA) to issue

a joint digital currency accepted in cross border transactions between two countries, using blockchain and distributed ledger technology.”

Demographics and geography set the scene for blockchain adoption

The strategic location, growing digital economy, and supportive regulatory environment play a huge part in making the Middle East attractive to blockchain/crypto firms and investors. Khan states that the fact that the region was also the fastest-growing

crypto market in the world caught the attention of investors and businesses alike. “The MENA region topped the world in crypto adoption, with an incredible 500% growth add $566bn in volume by crypto users between 2020 and 2021.”

Research from the OECD shows that young people constitute over half (55%) of the population across MENA, compared to 36% of the population in OECD countries. In fact, across most of the Middle East and North Africa (MENA) region, people from 15-29 years

of age constitute nearly one-quarter (24%).

As the region boasts a comparatively young and tech savvy population, Camarate argues that its state of art digital infrastructure and increasingly progressive regulators will position it as the go-to-hub for blockchain-based financial innovation. He adds

that use cases around savings and remittances have emerged in countries with fluctuating currencies, such as Egypt and Turkey, where devaluations are strengthening the appeal of crypto for savings preservation.

It is a “unique blend of factors” that make the Middle East an attractive option for startups and investors looking to grow their businesses and tap into new and emerging markets according to Dhriti Nath, product manager, NOW Money. “Along with its strategic

location it is home to a growing market of over 400 million people with a business-friendly environment with favourable regulations, tax incentives and low barriers to entry for startups and investors.” Nath also points out that the Middle East is a home to

a growing number of high-net-worth individuals and sovereign wealth funds, providing startups with access to capital to fuel their growth.

The Middle East's blockchain landscape presents a unique and promising opportunity. Cryptocurrencies have gained popularity in the region for distinctively contextual reasons, in parallel, governments in countries including the UAE, Bahrain, and Saudi Arabia

have actively embraced blockchain technology and established innovative regulatory frameworks.

The region’s strategic location, growing digital economy, and supportive regulatory environment make it an attractive destination for blockchain firms and investors, and financial institutions and fintech startups are increasingly finding ways to leverage

blockchain in their offerings.

With young and tech-savvy populations, advanced digital infrastructure, and government support, the region is poised for further advancements in blockchain adoption. As the Middle Eastern blockchain market continues to evolve, it has the potential to become

a prominent player in the global blockchain landscape, attracting increased investment and fostering innovation.